Customers and Portfolios

Overview

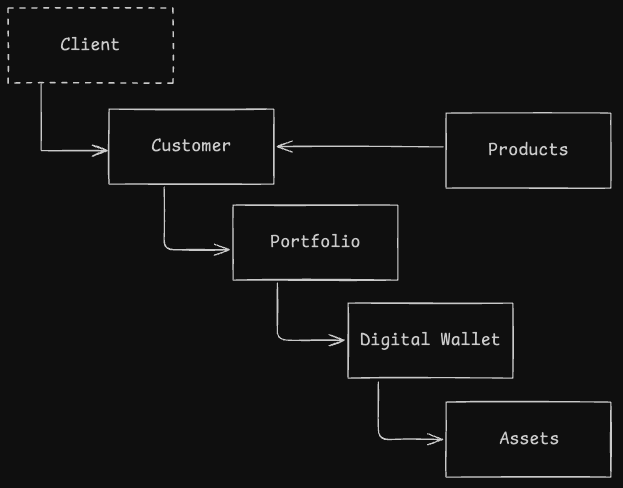

Our system is organized around a hierarchical structure that starts at the Client Account level and flows down to Customers, Portfolios, and Wallets. Each customer is associated with at least one portfolio, which in turn contains wallets that hold asset balances. This modular setup enables flexibility in how financial products are structured, while supporting scalable compliance and operational control.

Customers

Each customer is an end-user created under a client account. Customers can be either individuals or businesses.

Individuals

Individual users (e.g., John Doe) are a customer type that can hold wallets, receive payments, and access products like virtual accounts and cards. KYC is required for certain products depending on regulatory obligations. Customers are automatically provisioned with a default portfolio, which contains a digital wallet.

To create a new customer with an Individual profile, refer to the /customers/individual endpoint.

Businesses

Business customers are typically corporations (e.g. Acme Co.). They are not separate client accounts — they are still customers under the primary client account. Like individuals, business customers can access various financial products, but they may also be subject to KYB (Know Your Business) requirements.

To create a new customer with an business profile, refer to the /customers/business endpoint.

Compliance

AML-CTF

Connect Financial adheres to strict AML-CTF (Anti-Money Laundering and Counter-Terrorism Financing) guidelines. The specific requirements depend on the financial products the client has enabled (e.g., virtual accounts, cards, crypto vaults).

Reducing illegal transactions, fraud and risk is a shared activity with a goal of complete elimination. On top of Connect Financial’s requirements, all clients are expected to identify and enforce their own anti AML-CTF policies when interacting with our products and services.

KYC

KYC (Know Your Customer) checks are required for customers depending on the product type. The verification process may involve any or all of the following:

- Identity check

- Biometric passport (e.g. Liveness)

- Proof of address

- Declared occupation

- Virtual accounts currently require clients to conduct KYC through our KYC provider and upload the results into Base64 as part of the

/create_virtual_accountend point.

For most client implementations, Connect Financial will provide you tailored workflows through our KYC partners that can be easily integrated with your applications with minimal customization and engineering lift.

Speak to your Client Success Manager for more information.

KYB

KYB (Know Your Business) applies to business customers and includes validating the business's legal structure, registration, ownership, and operational intent. Required documentation may vary by product type and jurisdiction.

Depending on the nature of the businesses being onboarded, it may be required to complete additional KYC checks on Ultimate Beneficial Owners (UBO’s) related to the business.

Portfolios

A Portfolio is a container that holds one or more wallets within a customer’s account. Each customer must have at least one portfolio. Portfolios help organize different financial use cases (e.g., separating personal vs. business funds).

Key characteristics:

- Portfolios are linked to customers (i.e. Individuals or Businesses).

- Portfolios are automatically generated when creating a new customer record.

- Counterparties are optionally saved at the portfolio level.

- Each portfolio is automatically linked with a default wallet.

Most customers will operate with a single portfolio, but the system allows for multiple portfolios if needed. Speak to your Customer Success Manager to enable multi-portfolio use cases.

Key terms

- Client Account: The top-level organization entity.

- Customer: An end-user created under a client account (either an individual or a business).

- Portfolio: A container for a customer’s wallet/s.

- Wallet: Holds asset balances and is used for transactions.

- KYC/KYB: Compliance checks required for individuals and businesses.

- Counterparty: An external entity to whom a customer sends funds.